The case for a rent holiday for businesses on the coronavirus economic frontline

As the public health response to supress the COVID-19 virus ramps up, so to does the economic fallout. Shutdowns and enforced spatial distancing are necessary to try to prevent hospital intensive care units becoming overwhelmed.

But businesses on the economic frontline – those shut or soon to be shut down by the public health restrictions – need immediate help to get through.

The necessary temporary hit to business incomes need not become a permanent hit to productive capacity. We should not risk a large swathe of shops, cafes, pubs, hotels, gyms, and hairdressers going to the wall.

Most of these frontline businesses have seen their income dry up overnight. Some have temporarily closed, others are finding creative ways to make some money in online retail or takeaway services, for example, but most will replace only a fraction of their pre-crisis income.

Rent is the biggest barrier to survival

Staff layoffs, or more hopefully stand downs, are the only option for most of these business. Even substantial wage subsidies won’t entice business owners to keep staff on when the business has shut its doors.

For businesses on the economic frontline, most of their variable costs such as wages and stock can be suspended during the shutdown. But their fixed costs – particularly rent – are substantial.

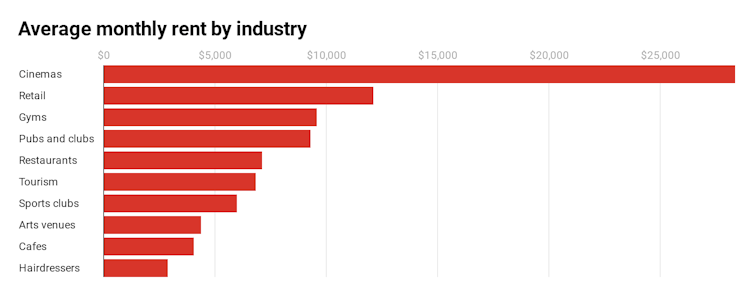

The average retailer pays almost A$12,000 in rent a month; the average gym, $10,000. Cafes and hairdressers are losing $3,000 to $4,000 each month in rent.

For most exposed businesses, rent sits at less than 20% of operating costs under normal conditions, but while they hibernate through coronavirus, that figure will reach somewhere between 80% and 95%.

Some schemes have already been announced to help these businesses. The Commonwealth’s is the largest, and will pay small and medium businesses 100% of salary and wages withheld for tax purposes up to $100,000. For businesses to qualify for the full amount, they will need to withhold the same amount, so will need to be paying staff.

State governments have announced partial relief of tax, rates and fees, and access to loans. This will help, but rent is the big unavoidable cost for most of the frontline businesses.

Exposed businesses will be losing thousands of dollars, or more, each month. Many will have some cash reserves, but for most a shutdown of three months or more will be very difficult to absorb.

A rent holiday, or at least a significant rent discount, would give these businesses a fighting chance at preventing a temporary shutdown becoming a permanent closure.

Market rates are close to zero

Most shopfronts can’t be put to other uses. That means the market price for retail, food, and accommodation services, and personal services shopfronts will be very close to zero during the shutdown.

Some landlords have done the right thing and given their tenants a rent holiday while these restrictions are in place.

This is smart: keeping their tenants in business will give these landlords the best chance of having a rented property when restrictions are lifted.

In normal circumstances, the market would work this through. But the danger here is it will happen too slowly. Some landlords refuse to accept renting out their premises for nothing.

In Melbourne, Chadstone retailers just wrote to Chadstone management asking for a rent holiday to “save our businesses”.

The response from management was no.

That mindset could send many thousands of shops, cafes, pubs, restaurants, hairdressers, gyms, cinemas, and tourism operators to the wall.

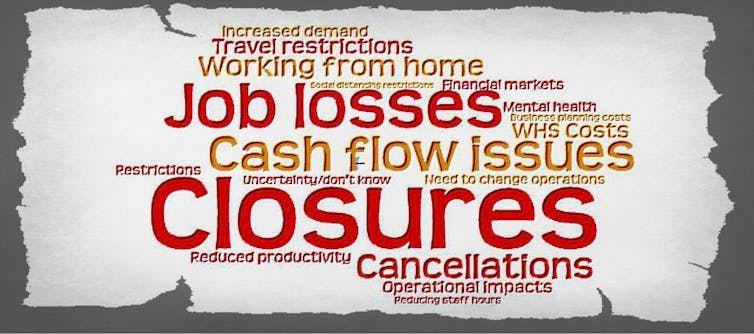

As of last week, more than 70% of businesses in these industries had already been hit by the COVID-19 crisis. That figure is expected to rise beyond 90% in the coming weeks.

“Closures” was the most common word used by business owners surveyed by the Bureau of Statistics about the future effect of COVID-19.

Preventing landlords from evicting commercial tenants, or requiring landlords to defer the rents, won’t help – businesses will still liquidate if they know they will be lumbered with many months of rent to pay back down the track.

While a short-term income hit for landlords isn’t insignificant, the damage to the economy will be much greater if a swathe of small and medium-sized businesses are lost.

Acting now will reduce the damage

The owners of some properties that need rental holidays still have to make monthly mortgage payments to banks. But the banks are offering loan holidays they might be able to take advantage of.

If there are gaps in the loan holiday arrangements, governments should work with the banks to ensure landlords are covered. Alternatively, governments themselves could offer partial compensation for lost rent.

Prosper Australia has suggested a uniform subsidy that replaces 50% of lost commercial tenancy mortgage payments.

Right now, hundreds of thousands of businesses are crunching the numbers to see whether than can stay solvent. With rent on the expense side, those numbers won’t add up for long.

Every state and territory government ought to enact a rental holiday for the types of businesses on the frontline of this crisis. As the economic shockwave reverberates, state and territory ministers should have the power to add other vulnerable industries to that list.

The key is speed. For every day they wait, hundreds of businesses will fold.![]()

Danielle Wood, Program Director, Budget Policy and Institutional Reform, Grattan Institute; Kate Griffiths, Fellow, Grattan Institute, and Nathan Blane, Analyst, Grattan Institute

This article is republished from The Conversation under a Creative Commons license. Read the original article.