Rest Super, Barings snaffle $780m Goodman industrial portfolio

Rest Super and US global investment manager Barings have struck the first major industrial portfolio deal of the year, after agreeing to pay $780 million for a collection of assets offloaded by Goodman Group that includes tenants such as Amazon and Metcash.

The acquisition of 12 assets spread across 70 hectares in Sydney and Melbourne comes while other portfolio offerings remain unsold, as vendors and buyers disagree over valuations following increased interest rates and bond yields.

Portfolio deals were the signature trades when the industrial property boom kicked off during the pandemic, headlined by Blackstone’s sale of its Milestone portfolio to ESR for $3.8 billion in 2021.

However, the last noteworthy industrial portfolio sale involved another superannuation fund, UniSuper, which paid $560 million in July to buy a half stake in 20 assets in Sydney and Melbourne, joining Dexus and Blackstone as co-owner.

Early last year, Logos was seeking buyers for a stake in a $3 billion, 10-asset industrial portfolio as sovereign wealth fund the Abu Dhabi Investment Authority sought to cash out, but no sale has been reported.

ESR, Stockland and Singapore’s CapitaLand were also shopping around industrial portfolios last year.

While the acquisition of the Milestone portfolio by ESR was struck on a yield of about 4.5 per cent, it is thought that the Barings-Rest portfolio deal was struck on a yield of around 5 per cent, given Goodman’s Australia and New Zealand portfolio trades on a cap rate – akin to an investment yield – of 5.1 per cent.

The deal struck by Barings and Rest Super follows the pair seeding a new $1 billion partnership last year with the acquisition of a warehouse in Melbourne’s west for $94 million.

North Carolina-based Barings, a subsidiary of Massachusetts Mutual Life Insurance Company, made its move into Australia commercial property in 2022, when it acquired local real estate investment platform Altis in 2022.

Soon after, Barings secured $600 million of fresh equity commitments from global institutions, providing it with enough capital to acquire a $1.2 billion-plus portfolio of commercial property.

The Goodman portfolio acquired by Rest Super and Barings includes 340,000 square metres of lettable area and tenants (in addition to Amazon and Metcash) such as Super Retail Group, Pack Rack and Iron Mountain.

A 115,000 square metre wholesale distribution centre leased to grocery giant Metcash – the largest of its kinds in Australia – accounts for a third of this space.

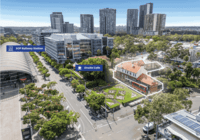

The Sydney assets comprise a mix of single and multi-tenanted industrial estates in infill locations experiencing strong rental growth.

The Melbourne assets are mostly newly complete or soon to be completed assets, which Goodman will still steer to completion. All are secured by long leases.

For Goodman, the divestment will allow it to recycle capital into its pipeline of new developments including a big play in the data centre sector. Goodman will provide a quarterly operational update on Wednesday.

Shaun Hannah, executive director of real estate at Barings, said the portfolio deal reflected the firm’s positive outlook for the industrial sector in Australia.

“It aligns with our investment strategy of targeting to buy existing leased buildings with significant underlying land value at attractive pricing,” Mr Hanna said.

“After investing successfully in the US industrial property sector and committing to a venture targeting the UK and Europe, we’re pleased to now increase our presence in the Australian market where there is continued strong demand for industrial property,” said Andrew Lill, chief investment officer at Rest Super.

“We believe there’s value in purchasing well-located industrial assets and we expect rents to increase materially over time.”