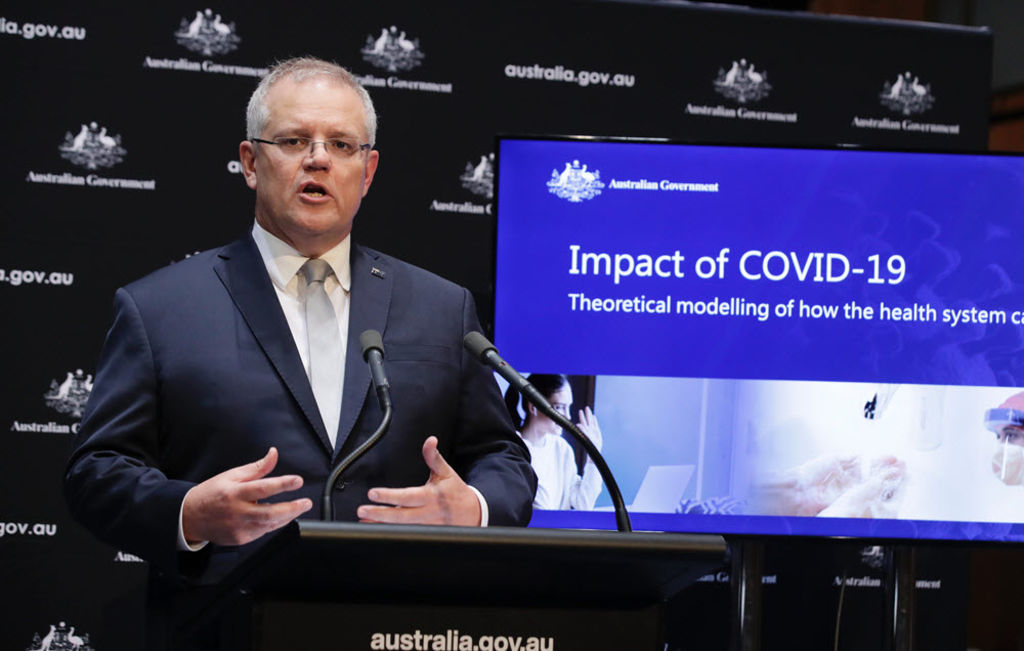

Prime Minister Scott Morrison confirms mandatory code for commercial tenants and landlords during coronavirus crisis

Commercial tenants in financial distress will receive rent reductions in the form of either waivers or deferrals to enable them to survive through the coronavirus pandemic, Prime Minister Scott Morrison announced on Tuesday.

As part of the latest set of measures to allow the economy to bounce back after the crisis has ended, the provisions are designed to ensure tenants can emerge at the other side of the crisis still in their premises.

The new proposals will be part of a new mandatory code of conduct for commercial tenancies to be legislated by each state and territory. It will bind both landlords and tenants – who have a turnover of $50 million or less and are eligible for the $130 billion JobKeeper program of benefits – to certain imperatives.

These will include landlords not being able to terminate leases or draw on their tenants’ security, tenants honouring their leases, and landlords reducing rent proportionate to the trading reduction of the tenant’s business.

This could take the form of a waiver to account for at least 50 per cent of the reduction in business, or deferral of rent that must be covered over the balance of the lease term, but for no less than 12 months.

“The arrangements will be overseen by a binding mediation process administered by the state and territories,” Mr Morrison said after the meeting of the national cabinet.

“It’s part of our ‘hibernation strategy’ to preserve as much of the foundations and pillars of our economy through this time to enable the economy to rebuild and grow on the other side.

“That means keeping the jobs. That means keeping the businesses. That means keeping the tenancies in place. That means keeping the leases in place and keeping the credit lines open to ensure the liabilities established or protecting against insolvencies or bankruptcies so on the other side of these crises, the economy will be able to rebound and regrow again.”

He said it was up to both tenants and landlords of small to medium-sized businesses to sit down and work out the arrangements that suited them best. “This must be shared and banks must come to the table and provide support for landlords, particularly international banks.”

“This preserves the lease, it preserves the relationship, it keeps the tenant in the property.”

In addition to this, Revenue NSW is now allowing land tax payments to be deferred interest-free for at least three months. Applications can be made to Revenue NSW either online or phoning them.

‘We’re going to have to wait for more detail’

Many of those working in the commercial sector, while broadly supportive of the announcement, still say they need to see more detail on how the code and its provisions will work before they can predict how effective it will be.

“It seems at this stage, there’s no free kick for anyone,” said Peter Messenger, principal at ResolveXO. “Even when rent is deferred, you’re obliged to repay it, although I’m assuming that will be interest free.

“I think we’re going to have to wait for more detail to come out. The federal government is providing the guide, but the states still have to enact it in the same way for it to be uniform.”

Another restraint was the upper limit of $50 million on the turnover for companies to take part in the scheme, said Mr Messenger, which would cut out a huge number of firms. “Even a lot of car dealers these days would be turning over more than that,” he said.

The success – or failure – of the new code would ultimately depend on landlords and tenants being able to come to an agreement, said Philip Reichelt of the Tenant Leasing Group.

“It’s nice that it gives us guidelines, but it’s still up to tenants and landlords to be able to negotiate,” he said. “Hopefully, they’ll be prepared to treat each other fairly and honestly and with respect through the process. Only then will the outcome be favourable for both.”

John Reed, director of LPC Cresa, representing tenants, also said it all came down to the two parties working together, and the government announcement was exactly as he’d expected.

“He’s basically saying that you guys need to get together and deal with the realities and cajoling us to create arrangements that will get us all through, and then creating a regulatory framework to effect that. I think it’s a pragmatic, practical and insightful response.”

Retail industry on board

Some of the largest groups in the retail industry also welcomed he prime minister’s announcement.

The Australian Retailers Association (ARA), National Retail Association (NRA), Pharmacy Guild of Australia (PGA), and Shopping Centre Council of Australia (SCCA) released a joint statement after the announcement saying they were “ready to work with the states to implement a sensible solution”.

“The Prime Minister and national cabinet can be assured that the ARA and our retail industry colleagues will work to ensure the code is progressed and applied in good faith. The most important issue is that the industry is talking, and landlords and tenants are working together to ensure business continuity,” said the ARA’s Russell Zimmerman.

The chief executive of the Shopping Centre Council, Angus Nardi, said the council had already agreed to alot of the principles under the code “including publicly and independently committing to not terminating leases for the non-payment of rent a few weeks ago”.

“Centre owners are receiving high volumes of requests for assistance. These are being worked through as quickly as possible”, Mr Nardi said.

But will landlords to the heavy lifting?

But agents’ groups were less enthusiastic.

Director of the Real Estate Institute of Victoria and partner at WB Simpson North Melbourne, Richard Simpson, said that while the announcement was “great news for tenants” the REIV was still holding out for landlord concessions including land tax concessions and rate reductions for the property owners who would need to accommodate the proposed rent waivers.

“I thought maybe the federal government might have gone to the party and given tax deduction for the rent that is being offset,” he said.

Mr Simpson expressed hope that the Victorian government would deal with the changes quickly and consider further concessions as part of the process.

“I have landlords who are self-funded retirees who need to pay these bills and are struggling to put food on the table,” he said.

The initial idea for the code was outlined on April 3, with the promise that there would be more detail to come. It follows other help from state and territory governments for businesses, with cash grants and deferrals of payroll tax.

with Jack Needham