GPT, Mirvac vie to run AMP's $7b office fund

ASX-listed GPT and Mirvac have firmed as shortlist candidates to take over running the $7 billion AMP Capital Office Fund, a flagship vehicle which AMP is fighting to retain as a key asset in the real estate platform it plans to spin off with its infrastructure business.

A review of options for AWOF as it is known, one of the country’s best-performing property funds, has reached the pointy end of the process, with a field of six top external property managers expected to be cut to a final two, which will vie with AMP Capital’s own proposal to keep control over the fund.

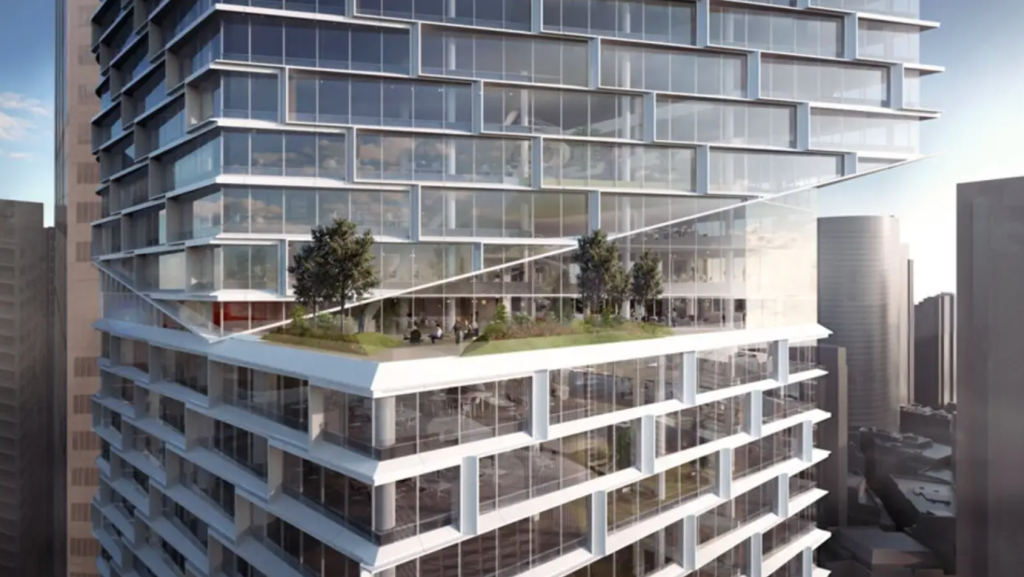

Its portfolio holds interests in some of the country’s landmark addresses such as Sydney’s Quay Quarter Tower, which is nearing completion, Angel Place on Pitt Street and, in Melbourne, Collins Place at the top of the city.

Inside the fund are a 40-strong group of wholesale investors including TCorp, Telstra Super, VFMC, and UniSuper which have grown increasingly restive in recent days. Those investors have stepped up the pressure on the fund’s trustee board – a three-man committee composed of senior AMP executives – to deliver a resolution on the fund’s future and restore stability.

In a separate move, TCorp this week pulled its infrastructure mandate from AMP Capital, taking in-house its management of its investments in a South Australian ports group and a Melbourne tollroad.

The review is being conducted by investment bankers at Jarden Australia in tandem with an independent advisory committee, led by respected director Paul Say. Their recommendations on shortlisting and ultimately a preferred manager go to the trustee board, while the final say rests with the investors, who have become more vocal in their views.

An earlier phase of shortlisting had narrowed the pool of candidates to ASX-listed Charter Hall, Stockland and Dexus, along with funds powerhouse QIC as well as Mirvac, led by Susan Lloyd-Hurwitz, and GPT Group, which is headed by Bob Johnston.

The outcome to the AWOF review is one of the most highly anticipated events in the commercial property sector this year, after the $5 billion AMP Capital Diversified Property Fund slipped out of AMP’s stable and merged with a Dexus-run fund in April.

The outcome of the review has potentially major repercussions for AMP’s once dominant funds management platform. Over the past year, the platform and its real estate operations in particular have lost a series of significant funds and mandates, while key executives have headed for the exit.

The $25 billion property funds business is a crucial cog in AMP’s private markets platform, which the wealth giant hopes to demerge from the AMP Capital platform and, coupled with its global infrastructure business, float as a separate listed funds operation.

As Mirvac and GPT hone their proposals for a final pitch, the process may yet involve a further twist. A key issue still on the table is whether the AWOF’s investors would opt for a straightforward manager swap to Mirvac or GPT or, under one proposal, merge into GPT’s existing unlisted office fund.

The option of remaining within the AMP Capital stable would also involve an element of uncertainty, given the ultimate ownership of the private markets business subject to whatever come after the demerger.