A rare slice of commercial real estate hits the Surry Hills market

A rare corner site in the heart of Surry Hills has hit the market, presenting a unique opportunity to get a foothold in one of the inner city’s most competitive commercial markets.

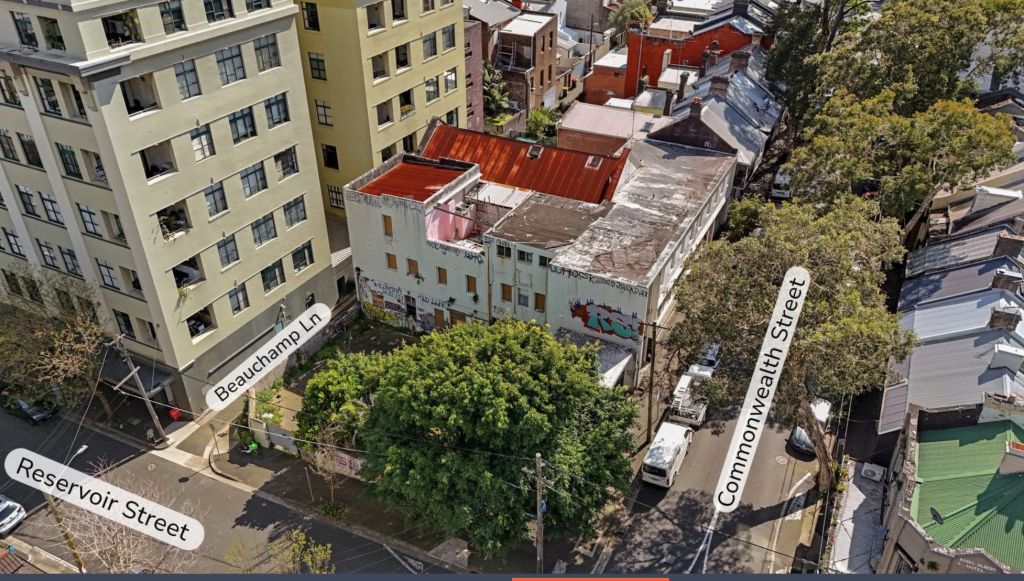

The property is located at 141–155 Commonwealth Street and combines scale with strong redevelopment potential, making it an alluring proposition for both investors and owner-occupiers.

Set on a generous 913 square metre landholding with three street frontages, it’s in an area long favoured by global tech brands and leading creative studios. The property arrives with DA approval by acclaimed architects SJB for a contemporary office and retail design. For buyers wanting to move quickly, the approval offers a ready-made blueprint. For others, the site’s history of concepts, including schemes for a 96-room hotel and student accommodation before that, highlights just how adaptable the site is.

Principal and selling agent Dominic D’Ettorre, principal at D’Ettorre Real Estate, says the ability to reposition the property to suit a wide range of end uses is already driving strong early enquiry.

“It’s either an investment or a corporate headquarters. In this area we often see buyers wanting to brand their own company; Surry Hills used to be the rag-trade capital, now it’s the IT and innovation hub with companies like Canva and multinationals anchoring the precinct,” he says.

Once the hub of Sydney’s textile and fabric trade, Surry Hills has transformed into an international lifestyle and commercial precinct, with some comparing it to Soho in New York City thanks to its cool brands calling the neighbourhood home and its many warehouses.

Its blend of heritage buildings, contemporary architecture, high-end dining and immediate access to Central Station has positioned it as one of Sydney’s most desirable bases for offices, hospitality, education and boutique accommodation.

Early interest since the campaign launch last Thursday has been encouraging, according to D’Ettorre, with both local and domestic enquiries from developers, hotel groups, education operators, commercial owner-occupiers and investors seeking long-term income, with multiple parties now in early due diligence and an offer of $21 million already received.

Expressions of interest close on December 17.