With demand surging for well-designed modern office fitouts nationwide, it’s essential to get your head around the changes you’ll need to make to keep up, with delays costing almost 15 per cent extra each year, according to research by global real estate services company JLL.

The hybrid-work model is now firmly implanted, so it’s crucial to attract and retain talent, especially among the younger Millennial and Gen Z crowds, by investing in high-quality spaces with better technology and wellness features, in spaces and designs that align with your brand.

Across Australia, 72 per cent of organisations plan to boost spending on office fitouts in the next five years, the report finds.

“As we move into 2025, we expect to see a surge in office renovations and upgrades across Australia,” says Alan McKay, managing director of project and development services for Australia and New Zealand at JLL.

“Early planning and strategic investments will be key to navigating the challenges of tight supply and rising costs,” he adds.

As the supply gap for grade-A offices continues to grow, business owners are focusing on lease renewals and upgrading existing tenancies by retrofitting in a flight-to-quality race outlined in the new JLL Global Office Fit-Out Costs Guide 2025. It’s become the “new normal”.

“The Australian market is showing a strong appetite for office upgrades enhancing the quality of space and technology,” says Allen. “We’re seeing a 14.59 per cent year-on-year change in average fitout costs, reflecting the increasing demand and complexity of modern office spaces.”

Let’s take a closer look at what’s involved in modernising your digs to meet ESG requirements, attract talent, and keep it. These are the costs, types of fitouts, layouts that cost the most, trends, and how to ensure seamless hybrid work.

Need an office upgrade? This is the cost of an average fitout in Australia

In 2025, Australian businesses can expect to pay on average $ 3220 per square metre for a fitout, based on a “moderate-style, medium-quality office” in a contemporary office building in the CBD, according to the JLL report.

An office fitting this description would have a flexible layout, an open floor plan and no enclosed offices. It would also host a high mix of open and closed collaborative spaces with agile work zones and focus areas. Overall, the project would be considered “standard” with average-quality materials and finishes used throughout, allowing for a few unique design features.

This “average office” was benchmarked around the globe – across 14 countries and 24 cities – taking into account hybrid working, with figures reflective of Q1 2025 analysis. JLL found that local market costs varied due to market nuances, labour costs, and regulations.

Australians face the third-highest costs globally, with Perth facing the highest charges in the nation.

“Australian office fitouts cost 31 per cent more than in the Asia-Pacific region,” JLL says.

Let’s look at the lowest and highest interventions, and how much specific layouts can set you back.

Fitout costs in Australia are a ‘strategic necessity’

Office costs in Australia range from around $2733 per square metre to $3418 per square metre on average, based on conversions of JLL’s Asia-Pacific data.

These three categories represent the quality and complexity of a fitout, from cheapest to most expensive:

- Baseline: A simple aesthetic with finishes focused on function;

- Medium: Standard project complexity with a few unique design features and average-quality materials finishes;

- High: Emphasises top-quality finishes, with increased effort spent on aesthetics and detailed design.

These three office layout categories vary in cost, from cheapest to most expensive:

- Progressive (open and flexible): an open floor plan with no enclosed offices. This means the prioritisation of open collaboration spaces and agile work zones distributed across the floor plan;

- Moderate (high spatial variety): an open plan with no enclosed offices. This means a high mix of open and enclosed collaboration spaces, agile work zones and focus areas;

- Traditional (structured): a focus on dedicated single desks, private offices and enclosed meeting rooms, with collaboration and social spaces clustered in one area.

Cheapest Australian office fitout costs

Baseline/progressive: A simple aesthetic with functional finishes paired with an open-plan space and open collaborative spaces will cost on average $2733 per square metre.

Baseline/moderate: A simple aesthetic with functional finishes paired with an open floor plan comprising a large mix of open and closed collaborative spaces will set you back on average $2960 per square metre.

Baseline/traditional: Simple aesthetic with functional finishes paired with dedicated single desks, private offices and enclosed meeting rooms with a cluster of collaborative and social spaces in one area, will see you drop an average of $3081 per square metre.

Most expensive Australian office fitout costs

High/traditional: At its most expensive, an aesthetically pleasing, high-quality and complex workspace with top-quality finishes paired with a conventional layout format, so everyone has a dedicated single desk, plus private offices and enclosed meeting rooms, will cost on average $3880 per square metre in Australia.

High/moderate: Here you get design and finishes with all the bells and whistles, paired with an open-floor layout, no enclosed offices, and a high mix of open and enclosed collaborative spaces, an average of $3722 per square metre.

High/progressive: High-end design and finishes paired with a simple floor plan, keeping the staff integration and flow moving at $3418 per square metre on average in Australia.

Sustainable office fitouts

“Sustainability is no longer just a buzzword in Australian office fitouts,” says McKay.

Sustainability is a key driver in fitouts, with environmental regulations, local government initiatives, and employee demand lifting the game for eco-friendly workspaces.

The nation’s authority on sustainable buildings and communities is the Green Building Council of Australia (GBCA).

GBCA promotes health and wellbeing in the design, construction and operations of buildings, fitouts and communities. The Green-Star rating system measures differences in fitouts and buildings, with six stars the highest achievable.

The New York-based International WELL Building Institute (IWBI) also provides wellness accreditation through its WELL Certification and WELL Ratings, on a mission to prove healthier, happier people perform better.

Long-term financial benefits of Green Star certified buildings include a 16.4 per cent increase in market value per square metre, a 13.5 per cent rise in annual returns, and 23 per cent longer Weighted Average Lease Expire (WALE), data reveals.

McKay says he’s seeing a “genuine commitment from organisations to create environmentally-friendly workspaces, which not only aligns with corporate values but also offers substantial long-term cost benefits”.

Government’s sustainability requirements “are putting upward pressure on fitout prices”, the report states. “Despite higher upfront costs, companies view this as a strategic investment in long-term value to achieve their pledged goals and commitments, operational efficiency, and resilience,” the report reads.

Cost drivers in Australia

Perth stands out as the most expensive Australian city for fitouts, while cities like Sydney, Melbourne and Brisbane closely follow, the data shows.

As Brisbane gears up to host the 2032 Olympic and Paralympic Games, the softer figures represent a rise in workforce demand.

“In Brisbane, the impacts of lower vacancy rates alongside the city’s preparation for the 2032 Olympics is driving fitout costs with an increased demand for skilled labour,” the report reads.

This demand for labour is echoed in Brisbane CBD car parks, the most expensive city in Australia to park your car, despite cheap public transport, according to Ray White Commercial data released this week. Meanwhile, Melbourne CBD parking rates have fallen below 2013 levels, indicating the city’s struggle to draw workers from their homes.

Supply-chain disruptions and rising material and labour costs have impacted fitout costs over the past year, the JLL report finds. With leaders cautious about spending too much on capital expenditure due to inflation pressures, fitout timelines suffer.

However, the Australian industry is “managing price pressures effectively” by adapting to local supply chains amid global economic uncertainty.

“Value engineering, specification refinement and local sourcing are gaining prominence as strategies to mitigate currency risks, supply chain disruptions and tariff-related cost uncertainties,” the report reads.

Fitout trends: Flight-to-quality, tech and wellness

The report highlights a flight-to-quality trend, where organisations prioritise high-quality spaces with enhanced technology and wellness features.

“What this means is that buildings that offer state-of-the-art ProTech and wellness facilities such as premium end-of-trip, as well as sustainability credentials, are front of mind for organisations looking to ensure their workplace continues to attract and retain top talent,” says McKay.

Flight-to-quality can be more broadly defined as the sudden change in investment behaviour during difficult financial periods, where investors ditch riskier assets for safer assets, such as offloading or upgrading lower-grade buildings if they can’t afford an A-grade office.

This is backed up by JLL figures, with 63 per cent of employers in Australia, compared with 54 per cent across the Asia Pacific region, planning to increase investment in an existing building refurbishment over the next five years.

Technology improvements vary from harnessing AI to world-class climate tech software to meet ESG requirements, data storage to seamless integrations between devices in-office and hybrid work, while reinforcing cybersecurity strategies.

Australian businesses are investing more heavily in AV and technology, reflecting the growing emphasis on supporting hybrid work models, the report finds.

Most tech investment is spent on audio-visual upgrades for better video conferencing,” says McKay, “to enhance experience and collaboration between office and remote workers.”

“Technology enhancements include increasing use of sensor technology to monitor how the workplace is performing and being utilised.”

Wellness trends don’t have to be all about aesthetically-pleasing design, though natural light, ventilation and biophilic elements are popular.

“Wellness features include premium end-of-trip facilities, gyms, and even golf simulators,” adds McKay. “There’s also a focus on WELL Ratings which address air-quality.”

WELL Certification at a Platinum level is the pinnacle of corporate wellness investment from the International WELL Building Institute (IWBI). Applying science, the authority assesses workplaces and buildings worldwide, with a critical focus on features that positively impact health, wellbeing and performance.

US corporate wellness trends of 2025 include several AI-powered investments and human-first approaches, according to Forbes, such as: “financial wellness” to relieve stress by offering personalised financial coaching and AI-driven budgeting tools; “personalised and proactive wellness” to tailor diverse staff needs such as stress management, weight concerns, nutrition and mental health aided by AI; “workplace design” to elevate overall morale and productivity; “menopausal support” in the form of flexibility, education and access to medical staff; and “expanded family care” to help balance caregiving responsibilities.

Workplace wellness is now seen as a strategic necessity to avoid productivity losses and voluntary turnover through burnout. Mixed with state-of-the-art coffee lounges, healthy meal vending machines and sparkling filtered water on tap, the return-to-office movement will stop at nothing.

The other kinds of wellness

Employees chasing work-life balance say flexible working arrangements, additional leave and time-in-lieu matter the most, SEEK research finds, echoing some of the human-first trends seen abroad.

In Australia, new work health and safety laws require employers to protect the psycho-social health of employees from job demands, among other hazards. The law reportedly prompted a wave of new Employee Assistance Plans (EAP) and wellbeing apps to enter the market, but without the proper research, employers risk just “ticking the box” on wellness.

As a leader, you can support your team by providing a mentally-healthy workplace through promoting diversity and inclusion, wellbeing programs and governing strategies, and seeking management training to help respond to staff challenges. You’re not a psychologist, but training in the space will help.

SEEK also recommends simple wellbeing improvements such as meeting regularly as a team, creating an open culture, normalising tricky conversations around illness and menopause, encouraging mindfulness practices, and sharing free resources from trusted sources like Headspace, Lifeline, Black Dog Institute and Beyond Blue.

Companies focused on high-quality fitouts

One company among the many companies that invest deeply in the aforementioned WELL Certification is biopharma giant GSK.

Last year, the firm achieved Platinum for its new Australian headquarters in Abbotsford. The fitout was undertaken at an undisclosed price and included colour-coded neurotype hot-desking, circadian lighting and ambient soundscaping designed to help its 180 employees thrive.

It joined law firm Lander & Rogers, sustainability consultants Arup and construction multinational Lendlease, among others, in a direction that guides investment in the workspace.

Sydney’s tallest office building, the fully-leased 55-storey Salesforce Tower, is another example of a national leader, developed and constructed by Lendlease. It recently achieved a six-Star Green Star rating, a NABERS 5.5-Star energy performance and was the city’s first WELL Core and SHELL pre-certified building.

Features include a water-efficient, climate-resilient design, responsibly sourced materials, and carbon-neutral construction. It also benefits from sensors that monitor air quality, temperature, acoustics and lighting levels, together with electric-vehicle charging stations and a tenant-exclusive EV car share program.

McKay says he’s seen a range of sectors investing in their workplaces, including tech, finance, and professional services.

“Due to client confidentiality, we can’t name specific companies, but the most investment is occurring in the technology, financial and professional services client sectors,” he says.

And the proof is in the pudding, correlating with “strong return to office trends (either through mandates or culture shifts) and the companies see the workplace investment as a way to attract and retain top talent.”

Global tech giant Amazon invested $1.5 billion in brand-new premium digs at 555 Collins Street, Melbourne, with 84,000 square metres of premium-grade office space fitted with retail, health and wellness facilities, and world-leading tech-enabled environments. Meanwhile, global tech giant Atlassian’s $1.4 billion Sydney tech precinct headquarters at 8-10 Lee Street, near Central Station – set to be the world’s tallest hybrid timber building – is due for completion this year.

How do companies cater for hybrid work?

McKay says specific hybrid-work accommodations in fitouts include increasing smaller meeting rooms and spaces to deal with the demand for more online meetings.

“This comes with an increase in audio-visual tech as well as increased acoustic treatments for privacy,” he says.

“Companies are also creating focus spaces to get work done between all the collaboration and socialising. Our Melbourne office library areas have been a huge win for productivity.”

Companies are diverse in their approaches to hybrid work implementation, adapting their strategies based on industry needs and organisational cultures, he says.

“Forward-thinking organisations marry their workplace and workforce strategies, carefully selecting office locations and designing spaces that authentically reflect their corporate vision and values,” he adds.

“This intentional approach ensures that physical workplaces support their people’s needs while reinforcing the company’s identity, ultimately creating environments where employees feel connected to the organisation’s purpose whether working remotely or in-office.”

101 Collins Street

JLL’s Melbourne headquarters at the prestigious 101 Collins Street, which has been operating since 1959, was recently upgraded with state-of-the-art technology and leading-edge sustainability practices.

Following a 12-month design process and briefing strategy, the workplace now spans two levels, blending a contemporary workspace with historical references and a new layout that mimics the Melbourne CBD grid.

The space includes a business lounge, creating an inspiring client experience while elevating the team’s day-to-day environment. At the same time, the aesthetic “is a warm, refined palette contrasted by cool-toned and edgy finishes”.

The building itself is also in the race for net zero with retrofit modifications including electrification, renewable energy and tech changes to enhance improvements.

“101 is committed to achieving net zero certification and becoming a carbon neutral building by 2025,” it stated in 2023.

“As well as progressing at a pace on its decarbonisation pathway, 101 engages with innovative technology to continuously support the improved efficiency of the building.”

Invicta House, Flinders Lane

Invicta House, a 100-year-old heritage-listed commercial office building at 226 Flinders Lane, re-opened last week after a major 18-month renovation and refurbishment breathed new life into the building to attract premium tenants.

The sympathetic renovation retains its historic charm while creating a modern, functional commercial office space in a B-grade building.

Features include two extra floors, two restaurants in the basement and ground floor, a new terrace and A-grade end-of-trip facilities aimed at quality tenants who may not want, or can afford, A-grade buildings.

The building, opened this week by the Lord Mayor of Melbourne, Nicholas Reece, is owned by St Real Estate. It was purchased in 2021 for $37 million with builder Dewcape completing the works.

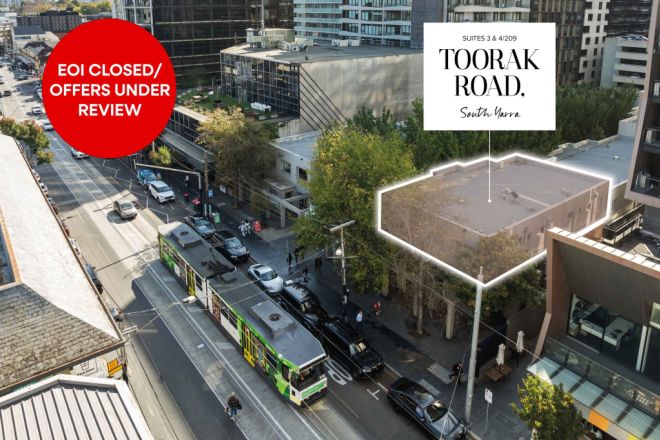

209 Toorak Road, South Yarra

Meanwhile, investors are being called to buy a pair of newly-updated offices boasting premium finishes and “architectural excellence” in Melbourne’s upmarket South Yarra.

The adjoining suites at 3 & 4 at 209 Toorak Road have secure keyless access, automated lighting and blinds, and four covered car spaces.

Designed by award-winning Jolsen Architects, the modern, light-filled workspaces are located moments from Chapel Street, South Yarra Station and elite amenities, just four kilometres from the CBD.

How do we stack up globally?

Australia comes in third, behind Singapore and Japan, with some of the most expensive costs in the world.

While costs in Australia are higher than the regional average, it’s a result of being a developed market with relatively high construction costs and being at the forefront of sustainable practices in the region.

The Asia Pacific rate is $2453 per square metre, while the global average is $ 3173 per square metre.

“Australia stands out as a robust and resilient market within the APAC region,” says Alan.

“Our economy continues to be bolstered by strong population growth and positive migration trends, contributing to a stronger economic outlook. This demographic shift is not just a number on paper; it’s reshaping our cities and driving demand for high-quality office spaces that reflect the evolving needs of our workforce.”